Introducing another awesome customer

Meet My Debt Plan. They’ve been experimenting with their landing pages to reach their goal of a 30% average conversion rate. Here’s their story:

My Debt Plan provides consumer debt advice in the UK. They have over 25 employees helping individuals stuck in the cycle of spiralling debt.

-

Joined Unbounce: August 2022

-

Plan: Concierge

-

Goals: Find qualified leads

-

Landing page needs: A fast way to launch campaigns and increase conversion rates

Here’s how the team generated over 3800 leads and average conversion rates of 17% in eight months.

Pro tip: automatic email notifications are a great way to send lead info directly to your sales team or clients, and you can set them up in minutes. Check out this 2-minute walkthrough video and learn more in this article.

Getting started with Unbounce

Charlotte Trotman signed up for a Concierge plan, which included tailored onboarding, page recreations, and ongoing 1:1 strategic support via the Concierge team.

“We signed up for the Concierge plan and it was the best decision. The landing pages we had were re-built by the Unbounce team, saving us a lot of time and effort especially being new to the eplatform].” —Charlotte Trotman, Marketing Manager, My Debt Plan

These pages highlight how My Debt Plan makes the debt repayment process easy by consolidating multiple debts into a single monthly payment, handling difficult conversations with creditors, and providing honest, confidential advice—plus some glowing 5-star reviews from their customers.

WEEK 1: Charlotte met her Concierge team to discuss account goals. They also re-built two of her pages in her Unbounce account

WEEK 2: Charlotte’s Concierge team led her through another tailored training session and she built new designs, connected domains, and set up integrations

WEEK 3: Charlotte had one more call with her Concierge team to make sure everything was working properly and hit PUBLISH! Talk about getting started quickly!

Optimizing for conversions with AI tools

Post-launch, Olly from the Concierge team ran Charlotte through a session to examine page speed, design improvements, competitor comparisons, and advanced features.

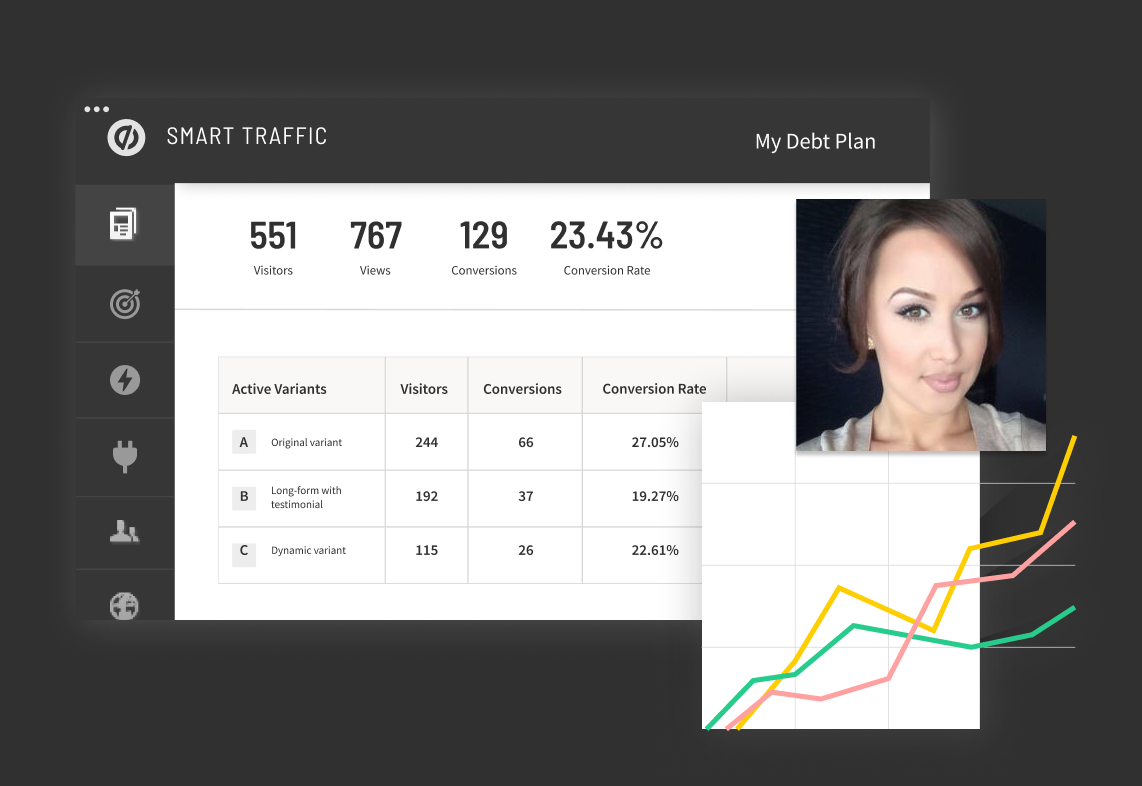

The next step? Optimization using Smart Traffic. Since implementing Smart Traffic, Charlotte has seen landing page conversion rates of over 23%—that’s nearly 1.5X better than the average conversion rate for finance and insurance industry pages.

“We’ve moved from predominantly using A/B testing to setting our pages to Smart Traffic. We think this is a great feature to push traffic as the system predicts which variant will convert higher for one type of customer against another.”

Up, Up, and Away!

So what’s next for Charlotte?

“Our focus for the next 3-6 months is striving to hit our target conversion rate of 30% across all the pages we have created. Some of them aren’t too far off—we have achieved a 31% conversion rate with one of our pages.”

To date, My Debt Plan has:

-

Published 24 pages

-

An average conversion rate of 17% across all the content in their account (and trending up the last few months)

-

Generated over 3800 leads (and counting!) for their sales team using automatic email notifications

Looking ahead, we’re excited to keep working with Charlotte and the My Debt Plan team to hit their goal of a 30% conversion rate across all landing pages. Next stop? Countless leads!

P.S. Looking for tailored landing page support like Charlotte? Learn more about our Concierge plans.